Enrolling in Medicare is a critical healthcare decision seniors must take once they retire from their work lives. If seniors visit primary care specialists who are enlisted within Medicare coverage, it can save them hefty medical costs. Although most people become eligible for Medicare when they turn 65, they may also run the risk of having to cover Medicare Late Enrollment Penalties if they do not pay during the Medicare Annual Enrollment Period (AEP). Failure to get coverage on time leads to penalties that can significantly increase Medicare costs over time and reduce benefits. Hence, make sure to follow the Medicare AEP to avoid penalties.

What is Medicare Penalty?

The Medicare penalty is a fine that beneficiaries pay when they fail to enroll in Medicare on time. The funding of Medicare health insurance comes from the federal government. Often Medicare beneficiaries only opt for the scheme when they are sick or require Medicare-covered services in order to bypass the premium payments. Medicare’s fund will shrink the more beneficiaries choose to use it only when they need it. Hence, these penalties are in effect to ensure that eligible Medicare beneficiaries do not delay enrollment.

Read More: 5 Tips for Finding a Medicare Primary Care Physician

When do you pay Medicare penalties?

Medicare has four parts, but three of them have penalties for late enrollment. Late enrollment penalties are applicable for Medicare Part A, Part B, and Part D if the beneficiaries miss enrolling for Medicare during the Initial Enrollment Period (IEP) and do not qualify for a Special Enrollment Period (SEP).

Medicare IEP

The Initial Enrollment Period spans seven months in total. It is divided into three time periods which are as follows and during which enrollment must take place.

- Three months before your 65th birthday

- The entire month in which you turn 65 or your birthday month

- Three months after your birthday.

Therefore, if you are turning 65 on January 10th, your IEP will begin on October 1st and end on April 30th.

Read More: Myth vs Fact: Can I Get Medicare if I’ve Never Worked?

Medicare SEP

If you miss the IEP, you can still enroll for coverage without penalties if you are eligible for SEP. The eligibility criteria for SEP includes a few special requirements which are as follows:

- You must have worked past the age of 65 and have medical coverage by an employer

- You are outside of the current plan coverage area

- You have lost current medical coverage

- You have an opportunity to get other coverage

SEP is also applicable when a plan changes its contract with Medicare. You can get an additional eight-month period to sign up for Medicare coverage during an SEP.

What are the Late Enrollment Penalties?

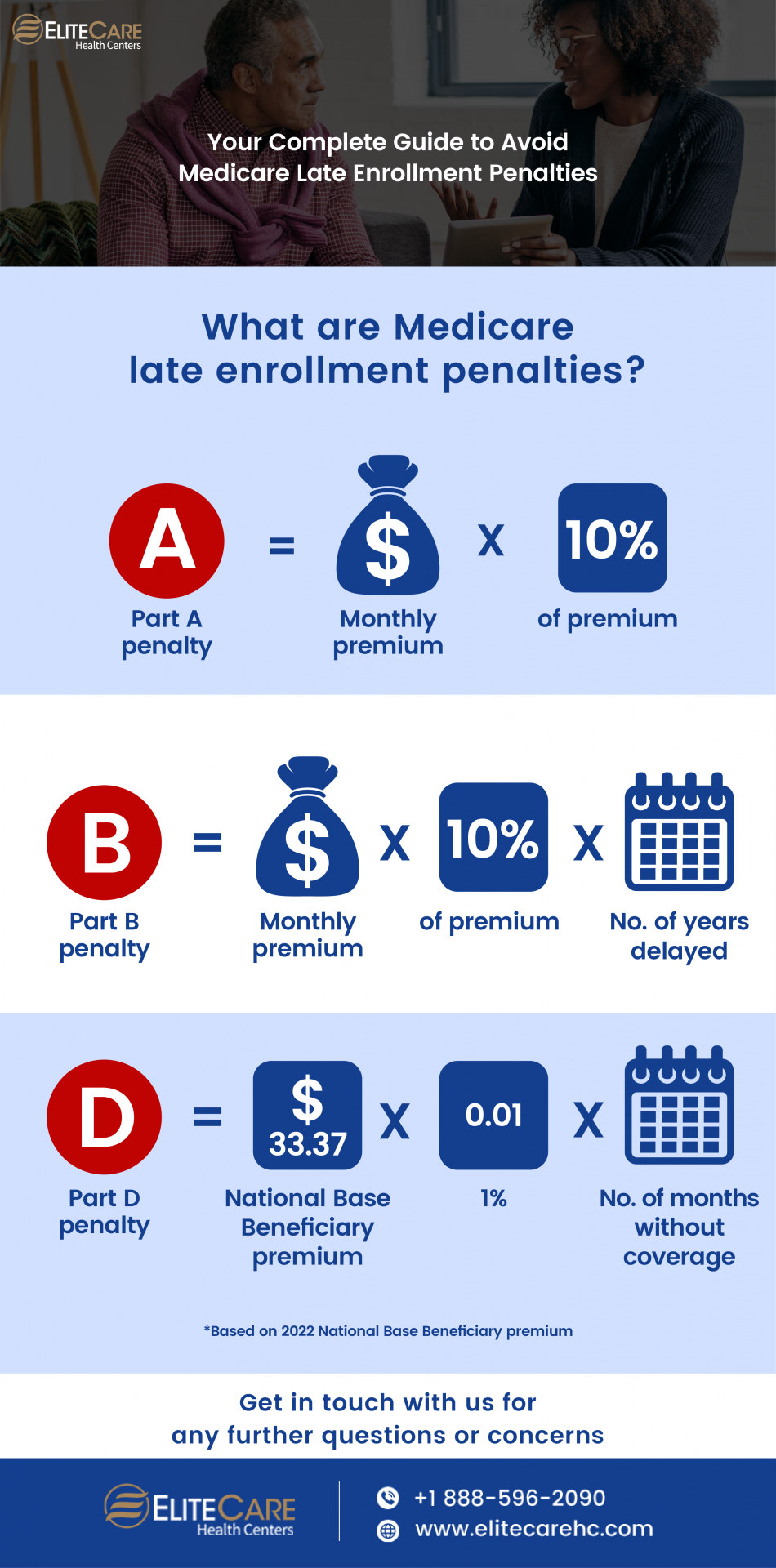

If you forget to sign up during the IEP or SEP, here are the three types of late enrollment penalties you will face –

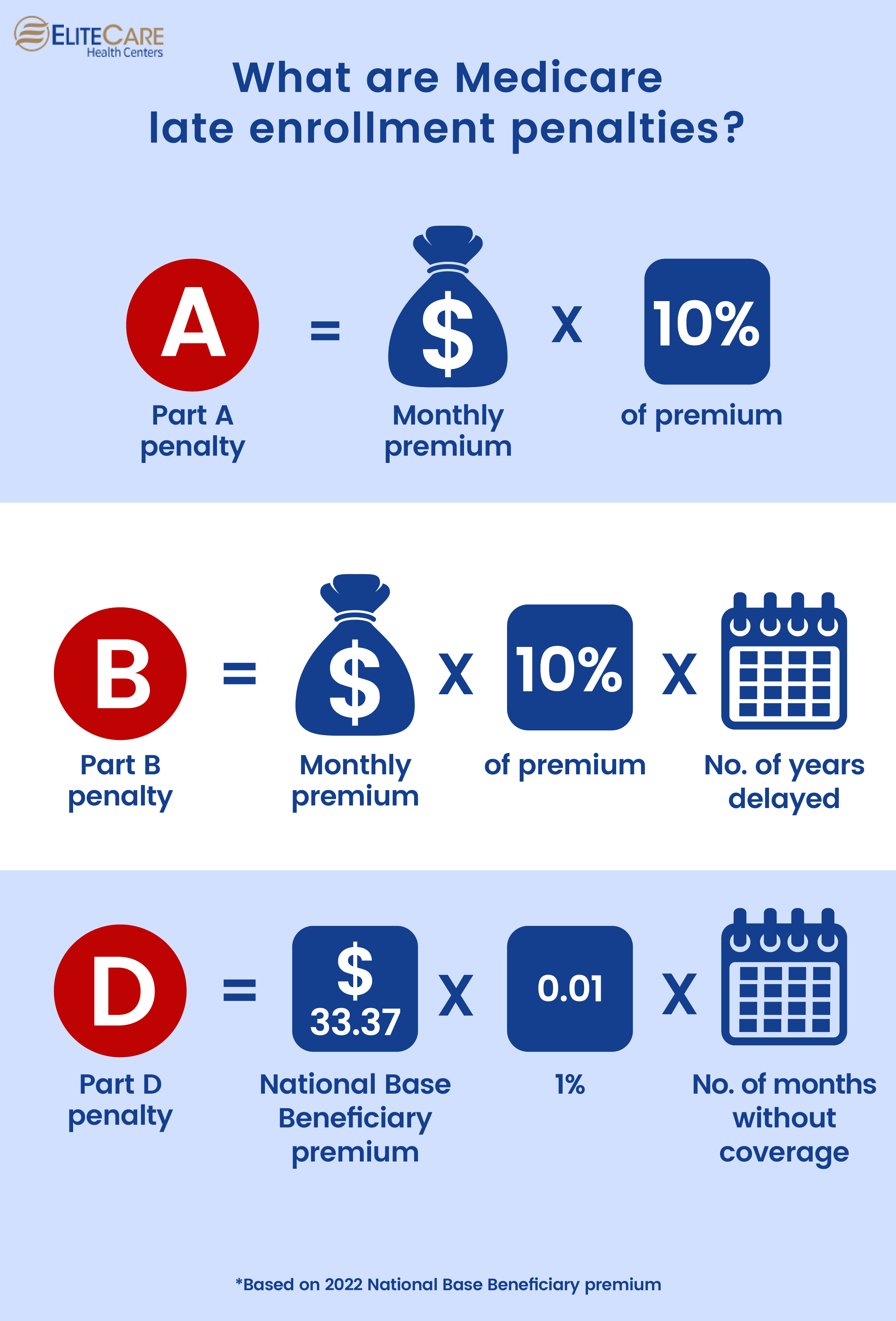

Part A

Late Enrollment Penalty

Beneficiaries who don’t qualify for premium-free Part A and don’t buy it during the SEP will have to cover Part A enrollment penalties. The penalty for part-A late enrollment is 10% of the monthly premium. However, most people are eligible for premium-free Part A if they have paid Medicare taxes for more than 10 years i.e., 40 quarters.

The penalty can significantly increase an applicant’s healthcare costs. It is because the applicants have to pay a higher premium for twice the number of years for which they failed to sign up. For example, if you were eligible for Part A for four years but didn’t sign up, you will have to pay the higher premium amount for eight years.

Part B

Late Enrollment Penalty

If you don’t apply for Part B on time and don’t qualify for premium-free Part B as well, then you will face a Part B late enrollment penalty. Your premium may increase by 10% for each 12-month period you could have enrolled in Part B – but did not. This is illustrated by the example below:

If your IEP ended in January 2022, and you did not sign up for part B until May 2022, your part B premium penalty would be 30% (3 x 10%) of the standard premium. Also, you will have to pay this penalty if you are enrolled in part B.

Enroll in part B without any delay because the penalty for this coverage can be substantial. It is a permanent penalty payable for the rest of your life.

Part D

Late Enrollment Penalty

The cost of part D late enrollment penalty depends on how long you have skipped enrolling for it. Part D deals with creditable drug coverage which has a buffer period of 62 days. Whenever you spend 63 days or more without drug coverage, you must pay a penalty when signing up for Medicare drug coverage later.

Medicare calculates the cost of the plan D late enrollment penalty by multiplying 1% of the monthly “national base beneficiary premium” ($33.37 in 2022) with the number of full, uncovered months you didn’t have part D coverage.

Read More: Decoding Medicare and Medicaid

Summing it up

We advise getting in touch with an expert as soon as you become eligible for Medicare. By doing this, you will not only avoid late penalties but also ensure that you choose a plan that suits your budget. Enrolling in Medicare on time ensures that you are not stuck with hefty lifelong penalties and you are not compromising on quality of healthcare.

- Tags:aep medicarebest primary doctors near meCenter For Wellnesscommon health problems in elderlyhealth and wellness centerhealth and wellness servicesmedical clinicmedicare primary care doctors near meprimary care physicianprimary care physicians of floridaprimary care specialistssenior care serviceswellness care centerswellness check doctor