The Centers for Disease Control and Prevention report that more than 12 million Americans aged 40 years and – older experience vision impairment. According to the CDC, this number will double by the year 2050.

Vision care is not only about getting a pair of eyeglasses or using doctor-prescribed eye drops. It refers to preventing or managing eye conditions with routine eye check-ups to maintain vision and avoid vision loss. Each visit to the health and wellness center, eye tests, prescription glasses or contact lenses, eye surgeries, etc. can be really expensive. The question then arises – while Medicare advantages apply for most healthcare costs for people over 65, does it provide vision benefits? Let’s dive into the details.

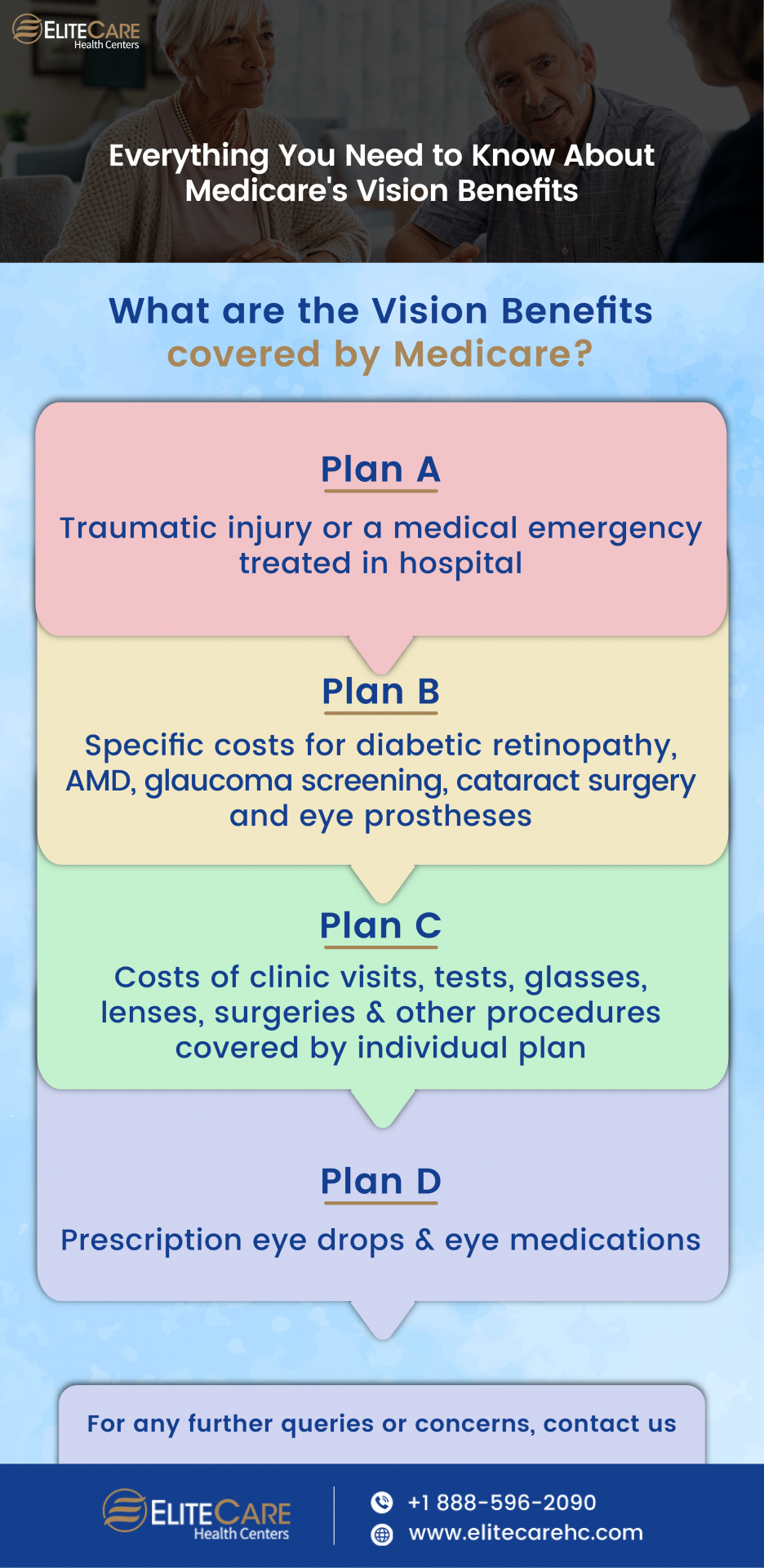

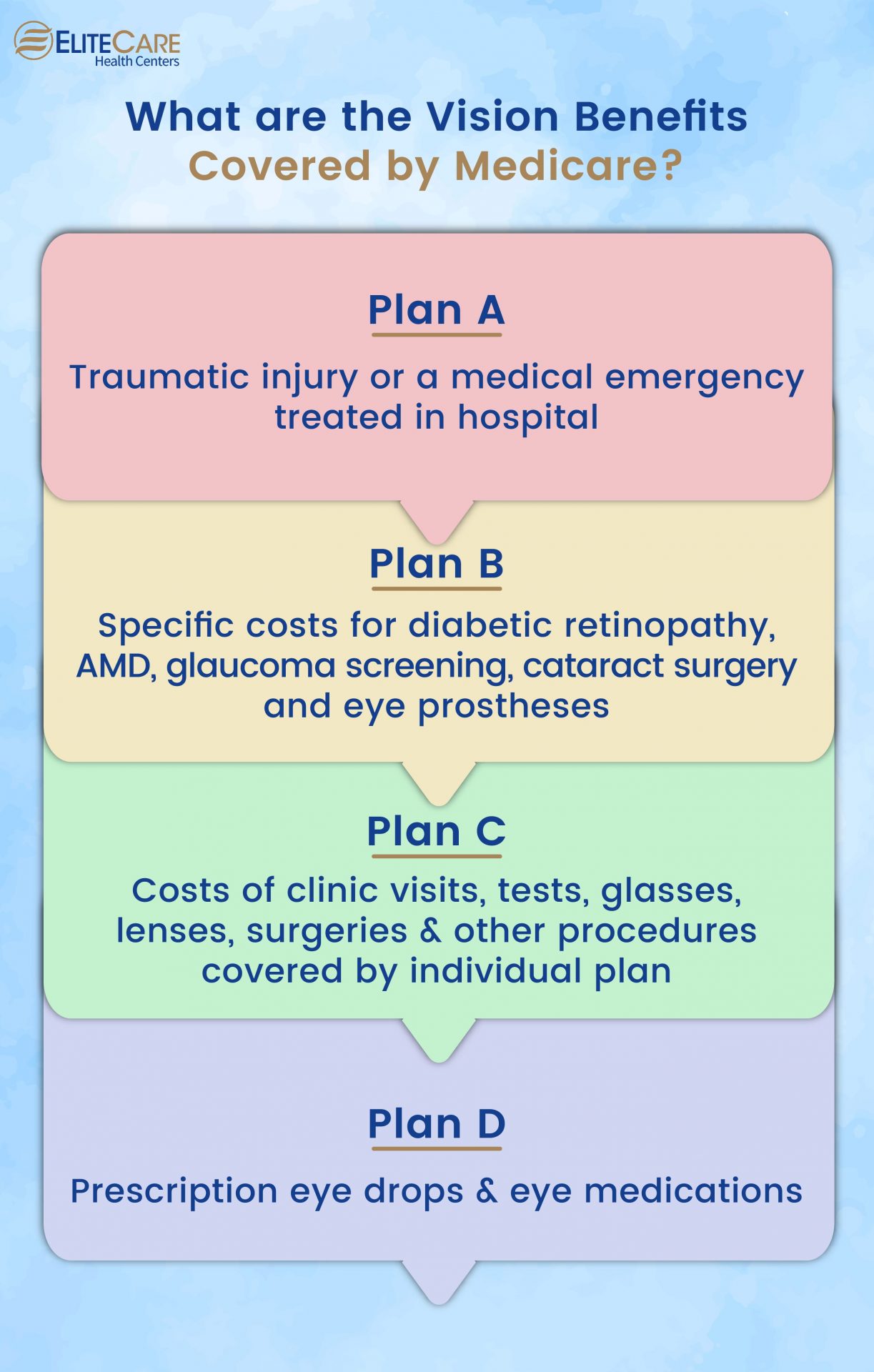

What are the Vision Benefits Covered by Medicare?

Regular eye exams are a very effective preventative tool to maintain eye health and catch vision-related problems early before they become more serious. But the original Medicare plans, Part A and Part B do not usually cover the cost of routine eye check-ups. Here is detailed guidance about vision benefits covered by Medicare.

Original Medicare - Part A

There is no coverage for routine vision exams or eye refractions under Medicare Part A. It is primarily a hospital insurance program and is applicable only when vision-related issues require urgent medical attention. Coverage will be applicable only in case of a traumatic injury or a medical emergency that requires seniors to visit the hospital. In this case, the beneficiary must get hospitalized as an inpatient at a Medicare-approved facility.

Read More: All about finding a Medicare doctor

Original Medicare - Part B

Routine eye exams and tests are not covered by Medicare Part B. But costs are covered under the following special circumstances:

- Diabetic retinopathy: Seniors suffering from diabetes are at a greater risk for diabetic retinopathy. For them, Medicare covers the cost of an annual eye examination to test for diabetic retinopathy.

- Glaucoma screening: Medicare covers yearly glaucoma screening for seniors at high risk. But the beneficiary must pay 20% of Medicare coinsurance out-of-pocket.

- Cataract Surgery: Plan B only covers expenses directly related to cataract treatment. It includes the cost of cataract surgery and the cost of the artificial lenses or glasses with standard frames required post-surgery. It also covers a pre-surgery exam, as well as surgery anesthetics.

- Eye prostheses: Benefits are available to individuals who require eye prostheses because of birth defects, surgical removal, or accidental damage. Seniors who have lost an eye or whose eyes have shrunk in size also fall into this category. In this situation, Medicare covers 80% of the initial prosthetic cost and the cost of reshaping and repairing within the first five years.

Read More: Can I Get Medicare if I’ve Never Worked?

Medicare Advantage plans - Plan C

While the original Medicare plans only cover the cost of eye exams for people diagnosed with certain eye issues, people at high risk for certain eye disorders, and people with concerning symptoms requiring evaluation, Plan C, however, offers more.

Plan C coverage can range from the cost of clinic visits, tests, eyeglasses, frames, lenses, and fitting exams for contacts, or glasses, to a few surgeries.

A few surgical procedures for which Medicare Plan C can bear the partial or full cost are as follows:

- Plan C covers the cost of certain surgeries such as cataract surgery, glaucoma surgery, and treatments for age-related macular degeneration.

- It also offers benefits for certain retinopathy procedures, including vascular endothelial growth factor inhibitors (injected medications), vitrectomy (removal of the jelly-like vitreous), and pan-retinal laser photocoagulation (a laser is used to burn and seal unwanted blood vessels).

However, most of these plans have some terms and conditions that specify how much the Plan will cover for eye care. In addition, these plans also outline some criteria for what kinds of eyewear seniors can choose, and how often they can use some services. Thus, consult an expert and enroll in the appropriate Advantage plan accordingly.

Prescription drugs - Part D

Since Medicare Part D plans only provide prescription drug coverage, eye drops, or eye medication prescribed by the optometrist may get covered by a Part D plan.

Does Medicare Supplements Cover Vision Care?

Medicare supplements (Medigap) were designed to help fill the “gaps” for out-of-pocket expenses. These expenses include copays, coinsurance, and deductibles incurred when a beneficiary accesses his or her Part A and B benefits. Hence, Medicare supplements, primarily Medigap, are limited to Medicare-covered services and there are no additional benefits included beyond original Medicare.

For instance, if a beneficiary is visiting an eye doctor for the treatment of glaucoma, the Medigap policy will typically provide the remaining 20% after Part B pays 80% of the Medicare-approved charges. Similarly, it will not cover the charges for routine vision exams or corrective lenses because these are not covered by Medicare Part A or Part B. However, some supplement plans offer discounted vision exams and glasses as an add-on or extra benefit for their members.

Read More: The Difference between Medicare and Medicaid

Estimated Cost for Vision Benefits Covered by Medicare

- Part A: The beneficiary typically pays a Part A deductible for each benefit period which was $1,556 in 2022 and covers the first 60 days of hospital care.

- Part B: It pays the cost of eye care both in and out of the hospital only under special circumstances. The beneficiary will pay 20% Part B coinsurance for each service.

- Part C: Medicare Advantage is run by private insurance companies and for this reason, the amount to be paid by a beneficiary depends on the specific plan and the insurance company.

Read More: A Complete Guide to Avoid Medicare Late Enrollment Penalties

Key Takeaway

On average, seniors enrolled in original Medicare pay less out-of-pocket costs, including premiums for their healthcare. While Medicare Advantage Plans are beneficial for eye care, they can lead to higher expenditures for other health issues. Hence, it is crucial to consult an expert before enrolling in any Medicare plan. For any further queries or concerns, contact EliteCare Health Centers.

- Tags:best primary doctors near meCenter For Wellnesscommon health problems in elderlyenrolling medicarehealth and wellness centerhealth and wellness servicesmedical clinicMedicare advantagesprimary care physicianprimary care physicians of floridasenior care serviceswellness care centerswellness check doctor