One of the most challenging issues that comes with approaching retirement is likely understanding Medicare. There are several types of Medicare plans, including Part A, Part B, Part D, and Medicare Advantage. Even the savviest retirees might find it challenging to determine when to enroll in Medicare and which parts to enroll in.

Here is a comprehensive guide on Medicare to help you understand this complex federal health insurance program for Americans who are approaching retirement. Understanding these concepts will enable you to make informed decisions that result in maximum benefits when it comes to your healthcare.

What is Medicare?

Medicare is a federal health insurance plan that is available to U.S. citizens who are 65 or older, disabled individuals under the age of 65, or those with end-stage renal disease.

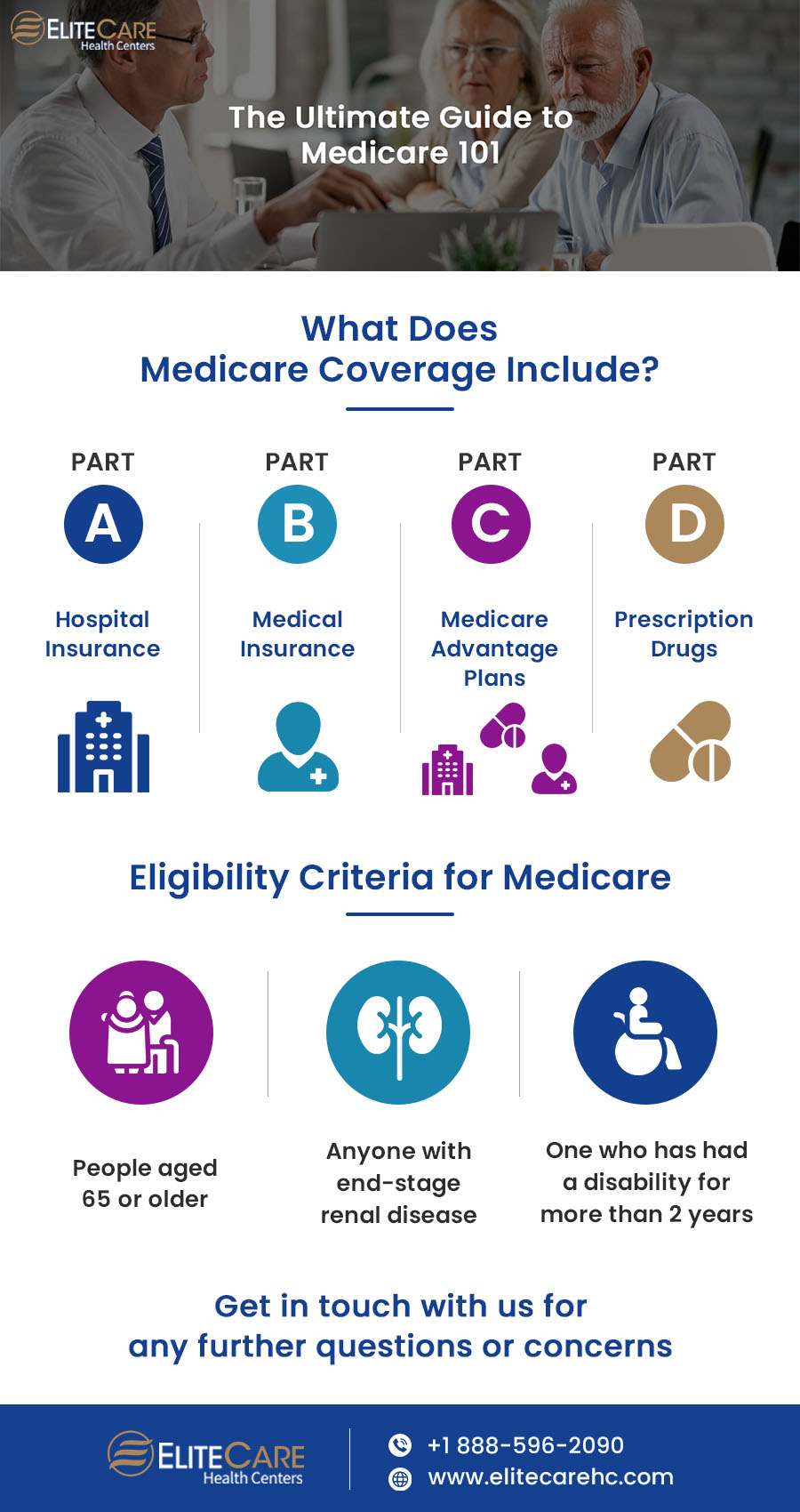

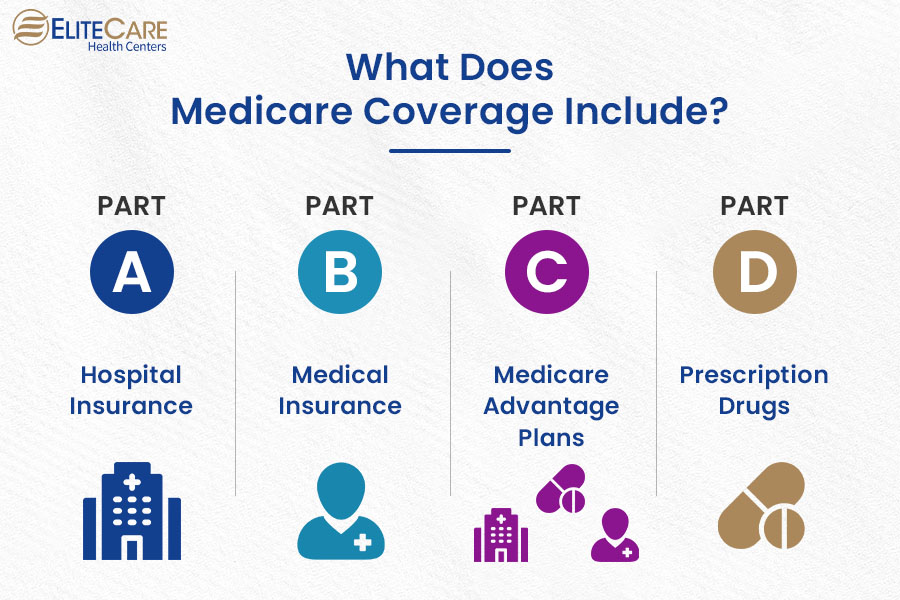

What Does Medicare Coverage Include?

The four components of Medicare are classified into sections called A, B, C, and D. While Medicare Part A and Part B are known as the original Medicare plans, Part C is provided by private insurers and Part D covers prescription drugs. Here is a detailed list of Medicare benefits that these plans cover.

Part A – It covers hospitalizations and other inpatient care.

Part B – This covers doctor visits, outpatient surgery, lab fees, and medical supplies.

Part C – Part C, often known as Medicare Advantage, is a privatized version of Medicare that is provided by private insurance companies. The advantages of Medicare Parts A and B are combined with extra advantages like prescription medication coverage, dental and vision insurance, and wellness incentives.

Part D – Commercial insurance companies offer Medicare Part D, which pays for prescription drugs. They either offer Medicare Advantage plans, which include prescription drug coverage, or Prescription Drug Plans, which separately offer Part D coverage.

What is the Difference Between the Medicare & Medicare Advantage Plan?

Medicare Advantage is a private company’s Medicare-approved health and medication coverage option that provides an alternative to Original Medicare. Part A, Part B, and Part D are all included in these plans.

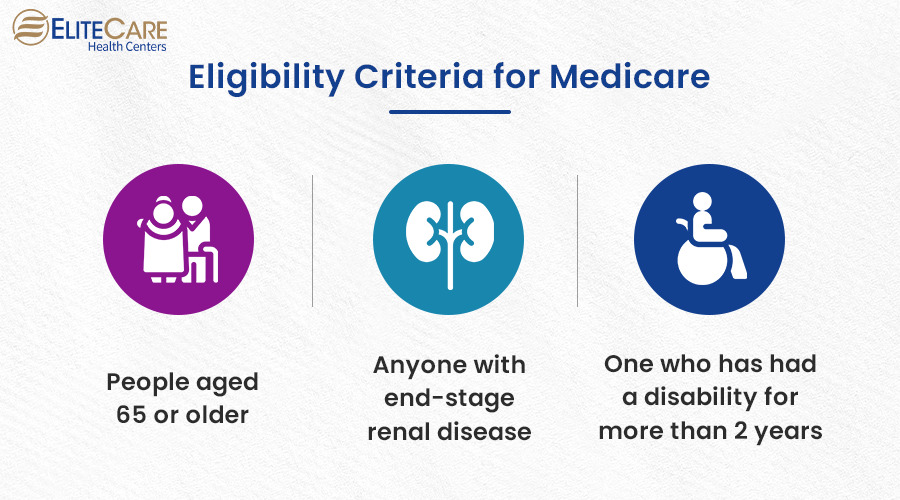

Who is Eligible for Medicare?

To be eligible for Medicare, an individual must meet certain requirements set forth by the Centers for Medicare and Medicaid Services (CMS). These are listed below:

- A person must be 65 or older to enroll.

- S/he must be a U.S. citizen or be a lawful permanent resident for five consecutive years.

- If under 65, a person who has had a disability for more than two years or has been diagnosed with an end-stage renal illness or Lou Gehrig’s disease (ESRD) can enroll.

Enrolling in Medicare During Your 60s

The U.S. government outlines the following to help you enroll in Medicare in your 60s:

- If you start receiving Social Security retirement benefits anytime from age 62 up to four months before your 65th birthday, you will be automatically enrolled in both Medicare Part A and Part B once you reach the age of 65.

- If you decide to apply for Social Security benefits three months before your 65th birthday or later, you can simultaneously sign up for Medicare while applying for Social Security.

- The Initial Enrollment Period for Medicare begins three months before you turn 65 and extends for three months after your 65th birthday, totaling seven months. Missing this enrollment window may result in penalties.

- If you’re still working and not ready to receive Social Security benefits at age 65, you can apply online for Medicare only. Alternatively, you may have the option to delay enrollment until you retire, taking advantage of a special enrollment period.

Medicare Enrollment Periods

Every year, during the open enrollment period, which lasts from October 15 to December 7 and depending upon your requirements, you can choose to do the following:

- Switch Part D or Medicare Advantage plans for the next year

- Choose between Medicare Advantage and Original Medicare

Also, between January 1 and March 31, Advantage subscribers can opt for the following:

- Change to a new Advantage plan or to basic Medicare

- Change to a Medicare Advantage or Part D plan outside of the open enrollment period provided it is offered in your area and has a five-star quality rating

Discover More: Your Complete Guide to Avoid Medicare Late Enrollment Penalties

How to Keep Track of Medicare benefits?

Create a myMedicare.gov account if you haven’t already. For the purpose of managing your personal data related to Original Medicare benefits and services, MyMedicare is a free and secure online service. Through their MyMedicare account, those with Original Medicare can check their coverage, enrollment status, and claims data. You may easily choose the drug plan that best fits your prescription list by viewing a list of all the prescriptions you’ve filled throughout the course of the year in your account. This process makes it easier for you to look for clinics and providers covered in your plan. For example, if you want to look for a health clinic in Florida that falls under your coverage, this tool can help quickly get you accurate results.

To understand what aspects to consider while choosing a Medicare plan, it is crucial to consult a primary care physician for a comprehensive health evaluation. For any queries or concerns about senior health, contact EliteCare Health Centers, one of the best healthcare centers in Florida that offers senior care services. Contact our medical clinics and schedule an appointment with our board-certified primary care physicians.

- Tags:best primary doctors near meCenter For Wellnesscommon health problems in elderlyhealth and wellness centerhealth and wellness serviceshealth clinic in floridamedical clinicMedicare advantagesmedicare benefitsprimary care physicianprimary care physicians of floridasenior care serviceswellness care centerswellness check doctor