The Medicare Annual Enrollment Period (AEP) is a specific time period when individuals can enroll in Medicare and modify their healthcare coverage. The AEP typically runs from October 15th to December 7th each year. It provides a great opportunity for an individual to assess their healthcare needs, review their current plan, and modify it if needed to get the most appropriate and cost-effective Medicare plan for the upcoming year.

In this blog post, we will share Medicare benefits as well as a comprehensive list of the dos and don’ts to consider during Medicare AEP. This guideline will equip individuals with the necessary information to help them make informed decisions that can enhance their healthcare coverage. Read on to learn more.

What Happens During Medicare AEP

During AEP, individuals can make the following changes:

- Switch from Original Medicare plans, namely Part A and Part B to a Medicare Advantage plan.

- Return to Original Medicare after switching to a Medicare Advantage plan.

- Change your plan from one Medicare Advantage plan to another Advantage plan.

- Choose or switch Medicare Prescription Drug Plans (Part D).

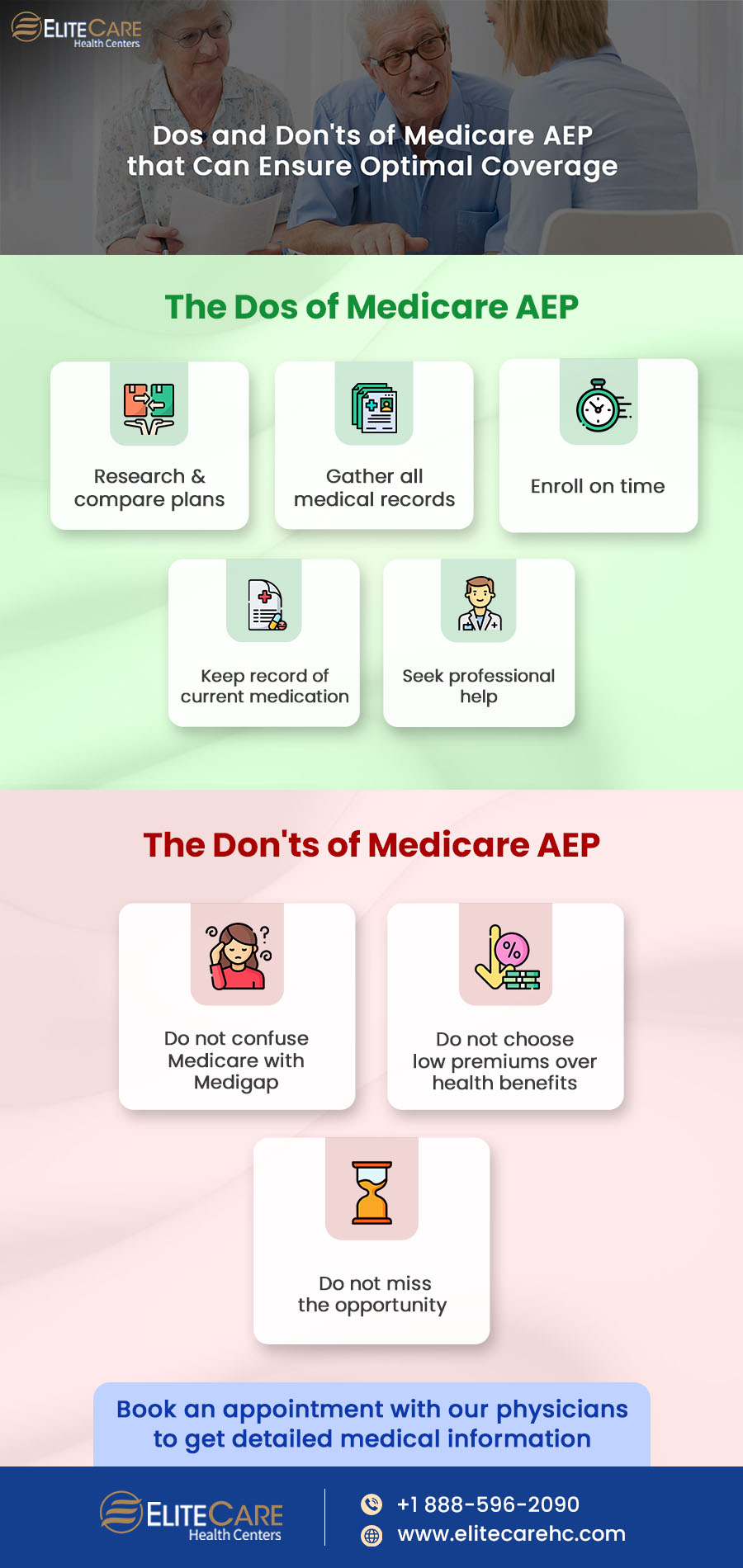

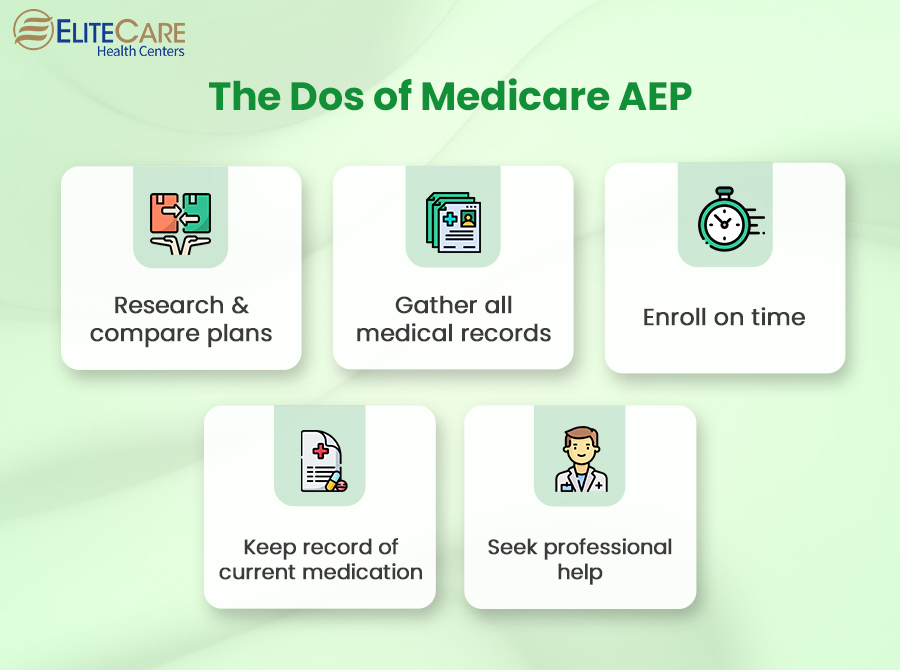

The Dos of Medicare AEP

1. Research & compare plans

Individuals should take the time to research and compare different Medicare plans for which they are eligible. Look into the Medicare benefits, coverage options, costs, networks of primary care physicians, medical clinics and hospitals, and prescription drug coverage.

Also, look for any changes in premiums, deductibles, or coverage that may affect their decision. Refer to the official website of Medicare for accurate information or consult any private insurance company for detailed guidance.

Read more: Changes You Need to Know Before Enrolling in Medicare

2. Evaluate your healthcare needs

It is crucial to consult a primary care physician and get a detailed idea about individual healthcare needs before Medicare AEP. Consider any changes that may have occurred since the last enrollment period. To gather relevant medical information, individuals can contact their medical clinic for medical records or consider asking the following questions from their primary care physician:

- What is my current health condition? Are there any changes or updates since my last visit?

- Should I be concerned about any upcoming medical procedures, treatments, or surgeries?

- Do I need to add any specialists or healthcare providers to my Medicare plan network?

- Do I require any specific medical services or therapies on an ongoing basis?

- Should I consider preventive screenings, tests, or immunizations in the upcoming year?

- Do you have any recommendations or insights regarding Medicare Advantage (Part C) or Prescription Drug (Part D) plans that may suit my healthcare requirements?

Individuals should bring a list of their current medications and any medical records or test results that may be relevant to the discussion.

3. Enroll on time

Medicare AEP has a specific enrollment period, which typically starts on October 15th and ends on December 7th every year. Some people may qualify for a Special Enrollment Period if they meet a few qualifying criteria, but it does not apply to everyone.

Hence, do not miss this enrollment period to avoid missing out on the opportunity to change ongoing coverage. Changes will be effective from January 1st of the following year.

Read more: How to Avoid Medicare Late Enrollment Penalties

4. Keep detailed record of the current medications

Most Medicare Advantage plans and Part D plans provide prescription drug coverage. Therefore, it is crucial to create a list that includes all the prescription drugs, the specific amounts one takes, and whether they are brand-name or generic. If the plan’s formulary (list of covered medications) does not include the names and dosages of the prescribed drugs, the plan may not cover them.

If beneficiaries receive an Annual Notice of Change Letter, stating the unavailability of any necessary medications in the formulary, it is time to find a new insurance provider.

5. Seek help from professionals

Medicare can be complex, with numerous plan options available for the beneficiaries. Therefore, consulting professionals specializing in Medicare plans, such as Medicare counselors, insurance brokers, or representatives from private insurance companies can help understand Medicare benefits and simplify the process. They have in-depth knowledge of the different plans and can help individuals navigate the options.

Also, healthcare needs differ for every individual. Professionals can provide personalized advice tailored to the unique needs and preferences of beneficiaries. They can review individual medical history, current health conditions, and medication requirements to recommend plans that fit into the budget and cover the services and prescription medications.

Read more: What Does Medicare Coverage Include?

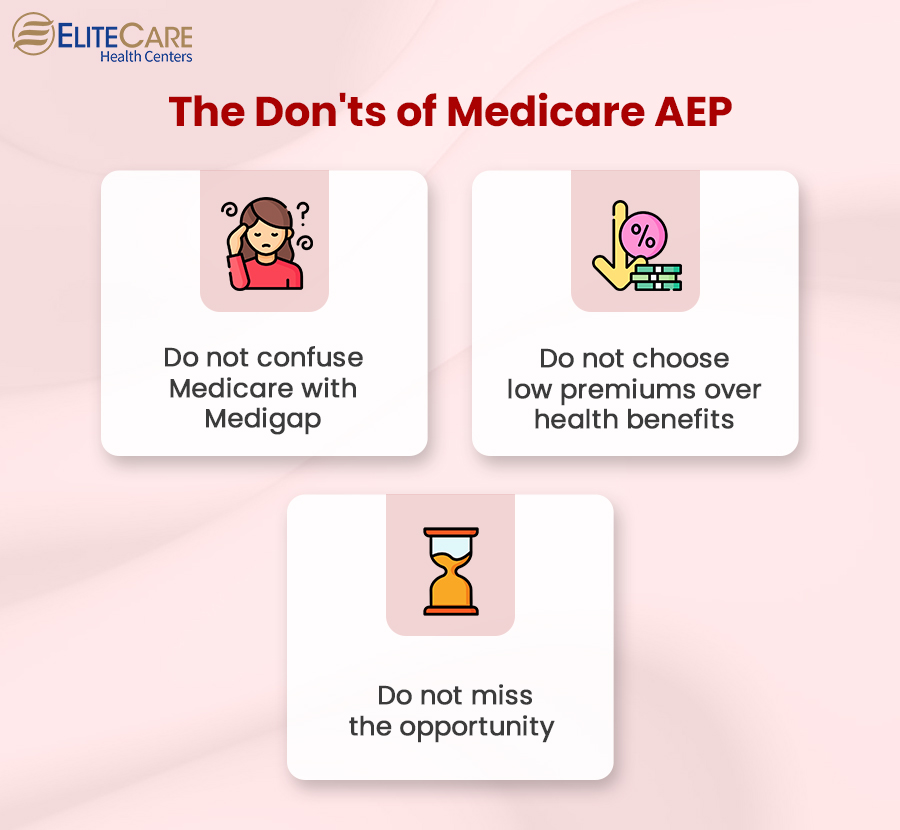

The Don'ts of Medicare AEP

1. Do not confuse Medicare with Medigap

New beneficiaries often do not have a clear understanding of Medigap and combine their initial Medicare coverage with a new Medigap plan during AEP. Medigap is the Medicare Supplement Insurance and is not the same as Medicare Advantage plans.

Medigap cannot be a replacement for Medicare Advantage plans since the benefits covered in the Advantage plans are not included in Medigap. The policies of Medigap work alongside Original Medicare to help cover certain out-of-pocket costs.

Individuals can sign up for a Medigap plan whenever they have an original Medicare plan in place. However, it is crucial to apply within the Medicare Supplement Open Enrollment Period, which starts at the same time the Part B plan goes into effect. Otherwise, it could result in a denial from the carrier.

2. Do not choose low premiums over benefits

Although low premiums may initially look attractive, it is crucial to evaluate whether the plan’s network and benefits align with the specific needs of the beneficiaries. Medicare Advantage plans often have appealing low monthly premiums and extra benefits that can be enticing. However, for example, choosing a Part C plan means having a much smaller network compared to Original Medicare coverage.

Consider account deductibles, copays/coinsurance, and any out-of-pocket maximums to ensure the smaller network of Advantage plans fits individual healthcare as well as financial requirements.

3. Do not wait until the next AEP

AEP occurs once a year from October 15th to December 7th, and if individuals wait until the next enrollment period, it can result in a coverage gap or missed opportunities to optimize healthcare.

However, in certain circumstances, waiting until the next AEP is the most appropriate option. Individuals who have recently enrolled in Medicare should give it some time to see how it works in the context of their needs and options.

Documents and Information to Prepare for Medicare AEP

1. Medicare ID Card

It contains important information including the Medicare number and the type of coverage beneficiaries have (e.g., Original Medicare or Medicare Advantage).

2. Current Prescription Medications

This is a list containing detailed information about all the prescription drugs beneficiaries currently take, including their names, dosages, and frequency.

3. Annual Notice of Change (ANOC) Letter

This document highlights any changes in coverage, costs, benefits, or provider networks for the upcoming year.

4. Personal Health Information

It is a record of personal health information, such as any pre-existing conditions, recent medical procedures or treatments, and any specific healthcare needs a beneficiary may have.

Read more: The Importance of Personal Health Record for Seniors

Conclusion

The Medicare Annual Enrollment Period (AEP) is an annual opportunity that helps beneficiaries to make changes in their healthcare plans. By following the dos and avoiding don’ts of Medicare AEP, individuals can navigate the enrollment process with confidence.

Contact EliteCare Health Centers, one of the best medical clinics and senior care service providers in Florida, and consult a board-certified primary care physician to gather all the required information about your health.